5 things to know for Primary Immunodeficiency Month

April is Primary Immunodeficiency Month, and in observation, Bio.News is partnering with the ...

Read More Life Sciences PA recognizes John F. Crowley for biotech leadership

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & ...

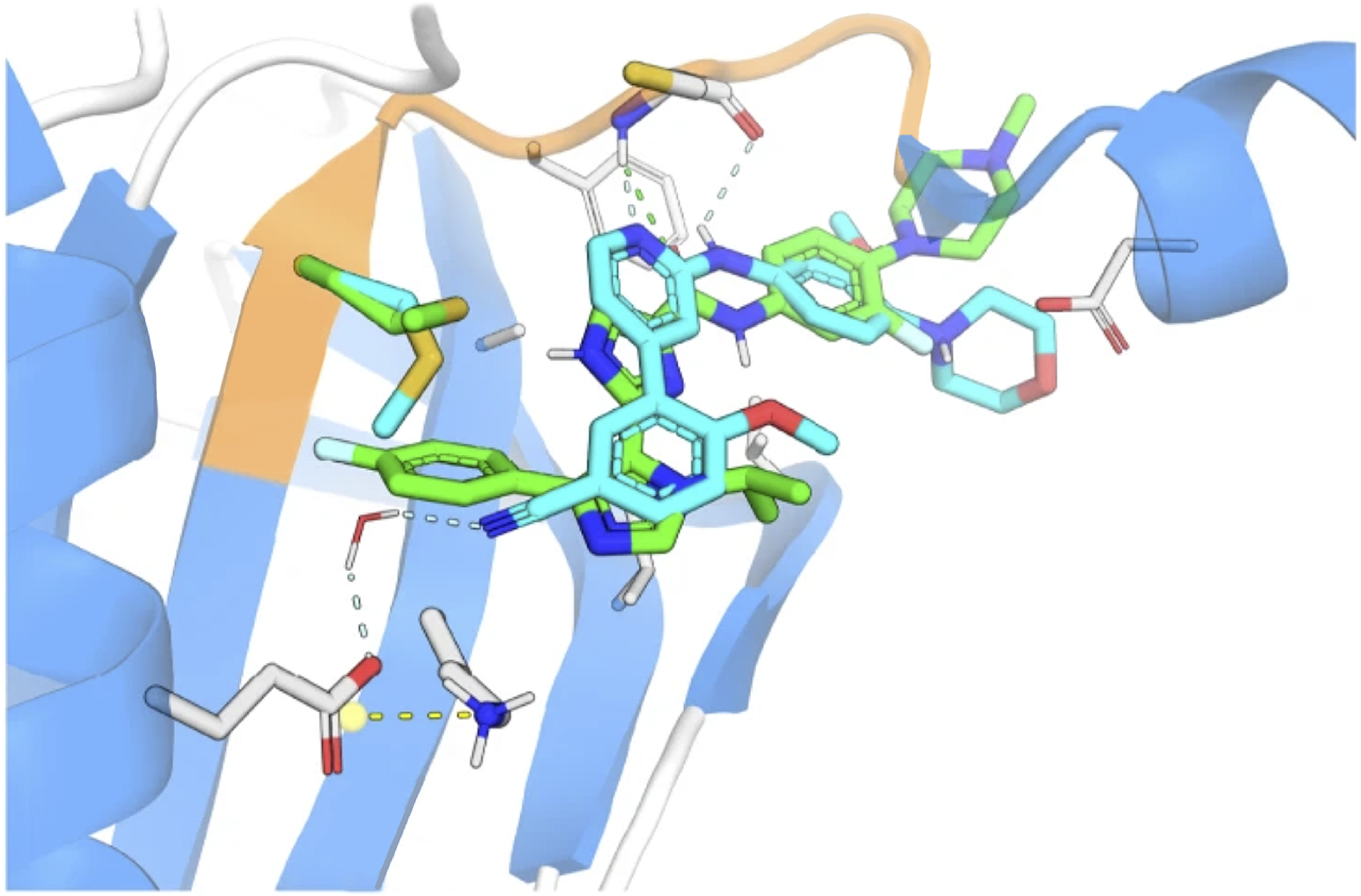

Read More Biotech and One Health are key to controlling avian flu

A recent human infection of avian flu in Texas, coming just days after ...

Read More Biotech is climate tech: how biotech is building a sustainable future

Biotechnology plays a pivotal role when it comes to mitigating climate change and ...

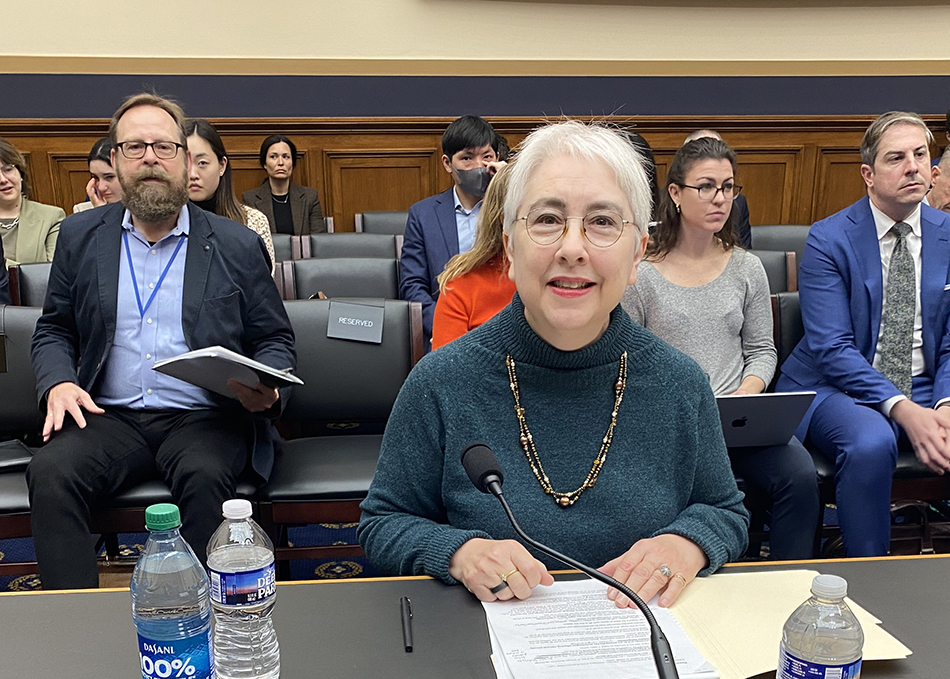

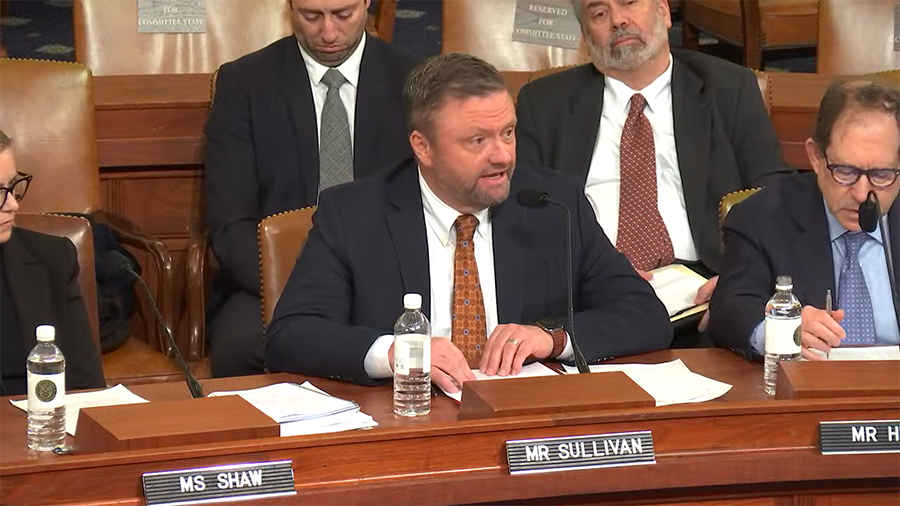

Read More People invent things – AI just helps, biotech IP expert tells Congress

Clear laws giving intellectual property rights to human inventors who use artificial intelligence ...

Read More Mobile BIOLAB brings STEM to Maine’s under-resourced middle schools

Students of rural and under-resourced communities in the state of Maine will have ...

Read More EDITORS' CHOICE

Biotech and One Health are key to controlling avian flu

A recent human infection of avian flu in Texas, coming just days after the first infections of U.S. livestock, has spurred research into the latest ...

April 15, 2024

Read More LATEST NEWS

Health

5 things to know for Primary Immunodeficiency Month

April is Primary Immunodeficiency Month, and in observation, Bio.News is partnering with the Immune Deficiency Foundation (IDF) to talk about the condition and what you ...

April 16, 2024

BIO's View

Life Sciences PA recognizes John F. Crowley for biotech leadership

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & CEO John F. Crowley the Hubert J.P. Schoemaker Leadership Award. The award ...

April 15, 2024

Agriculture

Biotech and One Health are key to controlling avian flu

A recent human infection of avian flu in Texas, coming just days after the first infections of U.S. livestock, has spurred research into the latest ...

April 15, 2024

Climate Change

Biotech is climate tech: how biotech is building a sustainable future

Biotechnology plays a pivotal role when it comes to mitigating climate change and reducing carbon emissions in many sectors, including health and agriculture. The new ...

April 11, 2024

Agriculture

People invent things – AI just helps, biotech IP expert tells Congress

Clear laws giving intellectual property rights to human inventors who use artificial intelligence will allow us to take advantage of the remarkable advances AI can ...

April 11, 2024

HEALTH

5 things to know for Primary Immunodeficiency Month

April 16, 2024

Biotech and One Health are key to controlling avian flu

April 15, 2024

5 reasons for investor optimism at BIO-Europe Spring 2024

March 29, 2024

Welcome, John F. Crowley!

Get to know John F. Crowley, the new President and CEO of the Biotechnology Innovation Organization (BIO), in our exclusive interview.

AGRICULTURE

Biotech and One Health are key to controlling avian flu

April 15, 2024

How biotech is improving the health of our pets

March 28, 2024

BIO announces first-ever Agriculture & Environment Summit

March 27, 2024

Climate Change

Biotech is climate tech: how biotech is building a sustainable future

April 11, 2024

Biotechnology plays a pivotal role when it comes to mitigating climate change and reducing carbon emissions in many sectors, including ...

Read More International Day of Forests: A call for more innovation

March 21, 2024

New Mexico legislature passes clean fuel standard

February 19, 2024

Federal Policy

Heart disease patients and the IRA’s misguided incentives

March 25, 2024

State Policy

Life Sciences PA recognizes John F. Crowley for biotech leadership

April 15, 2024

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & CEO John F. Crowley the Hubert J.P. ...

Read More Colorado PDAB could limit patient access to medicines

March 20, 2024

New Mexico legislature passes clean fuel standard

February 19, 2024

International

5 reasons for investor optimism at BIO-Europe Spring 2024

March 29, 2024

WTO Ministerial ends, no expansion of COVID IP waiver

March 4, 2024

BIO Board member tells Congress WTO IP waivers hurt innovation

February 8, 2024

LanzaJet opens world’s first ethanol-to-SAF production plant

February 6, 2024

Bio's View

Life Sciences PA recognizes John F. Crowley for biotech leadership

April 15, 2024

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & CEO John F. Crowley the Hubert J.P. ...

Read More 5 reasons for investor optimism at BIO-Europe Spring 2024

March 29, 2024

Heart disease patients and the IRA’s misguided incentives

March 25, 2024