BIO Agriculture & Environment Summit brings together bipartisan policymakers, regulators

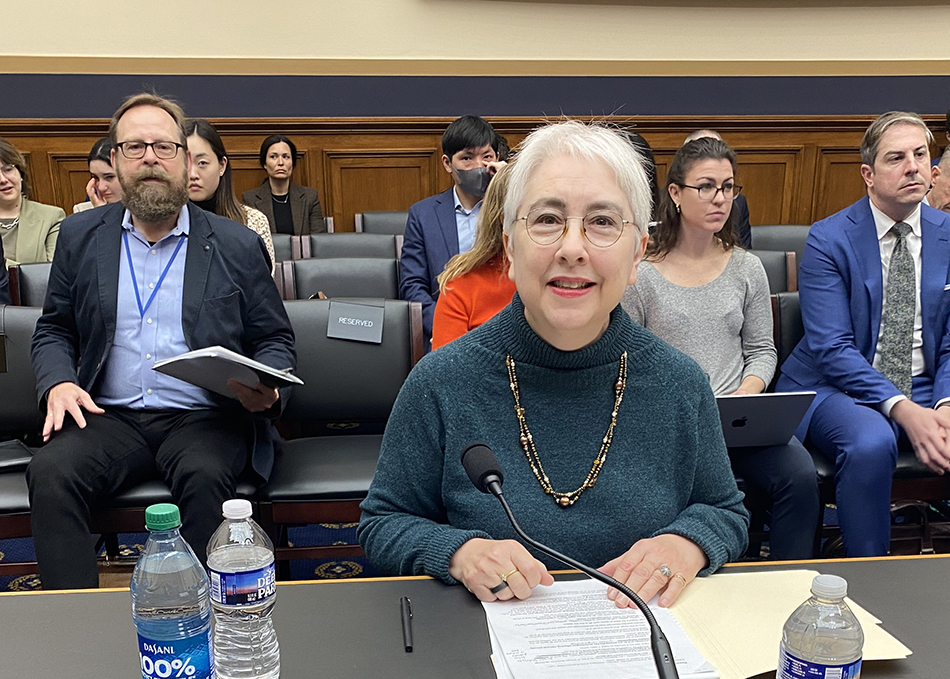

On April 18, BIO’s inaugural Agriculture & Environment Summit brought together bipartisan policymakers ...

Read More John F. Crowley: ‘Biotechnology is another word for hope’

On April 18, 2024, the Biotechnology Innovation Organization (BIO) held the inaugural Agriculture ...

Read More Social value of vaccines far exceeds their cost, new study finds

A recent study conducted by the Office of Health Economics (OHE, the world’s ...

Read More 5 things to know for Primary Immunodeficiency Month

April is Primary Immunodeficiency Month, and in observation, Bio.News is partnering with the ...

Read More Life Sciences PA recognizes John F. Crowley for biotech leadership

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & ...

Read More Biotech and One Health are key to controlling avian flu

A recent human infection of avian flu in Texas, coming just days after ...

Read More EDITORS' CHOICE

BIO Agriculture & Environment Summit brings together bipartisan policymakers, regulators

On April 18, BIO’s inaugural Agriculture & Environment Summit brought together bipartisan policymakers who emphasized the promise of innovation to address key challenges such as ...

April 19, 2024

Read More LATEST NEWS

Agriculture

BIO Agriculture & Environment Summit brings together bipartisan policymakers, regulators

On April 18, BIO’s inaugural Agriculture & Environment Summit brought together bipartisan policymakers who emphasized the promise of innovation to address key challenges such as ...

April 19, 2024

Agriculture

John F. Crowley: ‘Biotechnology is another word for hope’

On April 18, 2024, the Biotechnology Innovation Organization (BIO) held the inaugural Agriculture & Environment Summit in Washington, D.C., bringing together government and industry leaders ...

April 18, 2024

Health

Social value of vaccines far exceeds their cost, new study finds

A recent study conducted by the Office of Health Economics (OHE, the world’s oldest independent health economics research organization), and funded by the International Federation ...

April 18, 2024

Health

5 things to know for Primary Immunodeficiency Month

April is Primary Immunodeficiency Month, and in observation, Bio.News is partnering with the Immune Deficiency Foundation (IDF) to talk about the condition and what you ...

April 16, 2024

BIO's View

Life Sciences PA recognizes John F. Crowley for biotech leadership

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & CEO John F. Crowley the Hubert J.P. Schoemaker Leadership Award. The award ...

April 15, 2024

HEALTH

5 things to know for Primary Immunodeficiency Month

April 16, 2024

Biotech and One Health are key to controlling avian flu

April 15, 2024

Welcome, John F. Crowley!

Get to know John F. Crowley, the new President and CEO of the Biotechnology Innovation Organization (BIO), in our exclusive interview.

AGRICULTURE

John F. Crowley: ‘Biotechnology is another word for hope’

April 18, 2024

Biotech and One Health are key to controlling avian flu

April 15, 2024

Climate Change

BIO Agriculture & Environment Summit brings together bipartisan policymakers, regulators

April 19, 2024

On April 18, BIO’s inaugural Agriculture & Environment Summit brought together bipartisan policymakers who emphasized the promise of innovation to ...

Read More John F. Crowley: ‘Biotechnology is another word for hope’

April 18, 2024

International Day of Forests: A call for more innovation

March 21, 2024

Federal Policy

State Policy

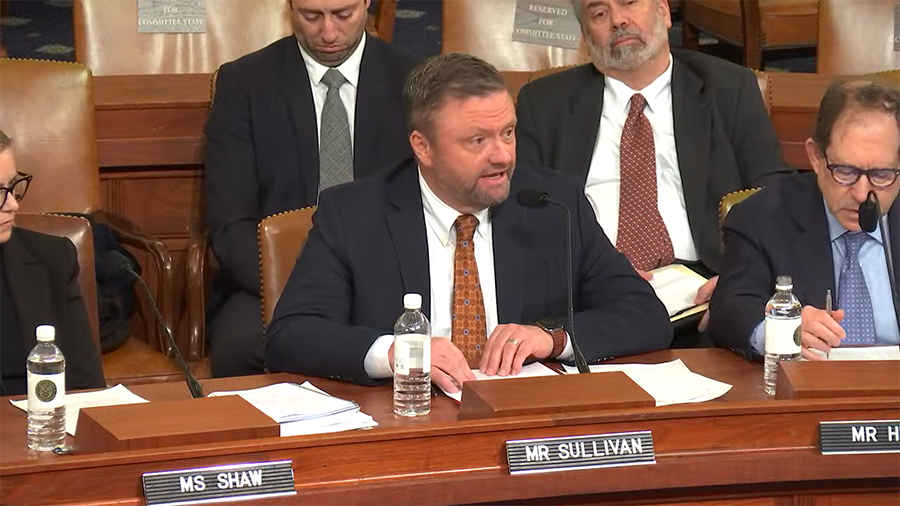

Life Sciences PA recognizes John F. Crowley for biotech leadership

April 15, 2024

On April 10, Life Sciences PA awarded Biotechnology Innovation Organization (BIO) President & CEO John F. Crowley the Hubert J.P. ...

Read More Colorado PDAB could limit patient access to medicines

March 20, 2024

New Mexico legislature passes clean fuel standard

February 19, 2024

International

5 reasons for investor optimism at BIO-Europe Spring 2024

March 29, 2024

WTO Ministerial ends, no expansion of COVID IP waiver

March 4, 2024

BIO Board member tells Congress WTO IP waivers hurt innovation

February 8, 2024

Bio's View

John F. Crowley: ‘Biotechnology is another word for hope’

April 18, 2024

On April 18, 2024, the Biotechnology Innovation Organization (BIO) held the inaugural Agriculture & Environment Summit in Washington, D.C., bringing ...

Read More 5 reasons for investor optimism at BIO-Europe Spring 2024

March 29, 2024