Member Benefits on R&D Tax Credits with ADP

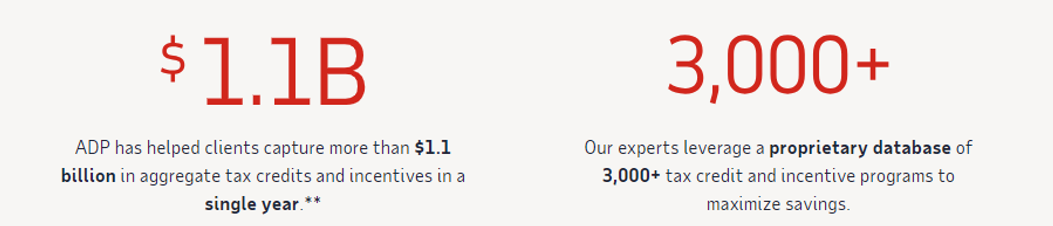

Members receive a 20% discount on ADP R&D tax credit services, designed to help you maximize federal and state tax credits while reducing your effective tax rate.

Exclusive member benefits include:

- 20% discount on ADP R&D Tax Credit services.

- A complimentary initial assessment to estimate potential credits.

- A refund clause included in every member engagement.

- A comprehensive study of qualified expenses, conducted by a team of experienced tax professionals.

- Access to a dedicated team of R&D experts trained to help you maximize your credits.

- Available to current ADP payroll/PEO clients and member companies using other third-party payroll systems.

The R&D Tax Credit Offering for Life Sciences

For more than 50 years, innovation has powered the U.S. economy. If your company is engaged in research and development (R&D) but hasn’t claimed the R&D tax credit, you could be leaving significant tax savings on the table.

ADP’s experts bring together proprietary technology and unmatched experience to help life sciences organizations claim valuable credits — so you can fuel innovation while offsetting expenses with confidence.

ADP is part of BIO Business Solutions®, the cost-savings program that helps life science companies reduce overhead and scale more efficiently.