Members enjoy exclusive opportunities - from advocating for policies that spur innovation to receiving discounts on BIO events and through BIO’s own cost-saving program. Unlock the possibilities and join us today.

Become an advocate for biotechnology and help shape policy that promotes innovation! Contact policymakers directly through BIO’s easy-to-use tool and have your voice heard.

BIO Early-Stage Resources Hub

BIO launched a powerful tool with exclusive resources to help early-stage and startup biotechs save money and stay up to date on the latest insights.

BIO Webinars

BIO’s free educational webinars cover topics ranging from policy to capital raising to member services—anywhere, anytime from your own device.

Price controls on the U.S. Biopharma Ecosystem

New research by Vital Transformation: Inflation Reduction Act hampers R&D across therapeutic areas.

The Biotechnology Economic Impact Map

Biotech’s Economic Impact. Go inside the BIO member companies driving the bioeconomy nationwide.

BioSafe

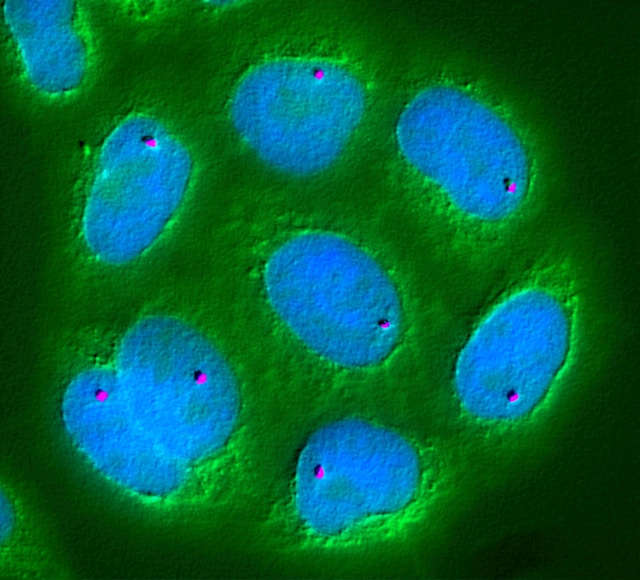

Since 2003, BioSafe, BIO's preclinical safety committee, has been driving innovation in biopharmaceuticals by addressing key regulatory and scientific issues.

Nature's Building Blocks

Explore inspiring videos about how biotech is solving our world’s biggest sustainability, health, and equity challenges, produced in partnership with BBC StoryWorks.

BIO Early-Stage Resources Hub

BIO launched a powerful tool with exclusive resources to help early-stage and startup biotechs save money and stay up to date on the latest insights.

BIO Webinars

BIO’s free educational webinars cover topics ranging from policy to capital raising to member services—anywhere, anytime from your own device.

Price controls on the U.S. Biopharma Ecosystem

New research by Vital Transformation: Inflation Reduction Act hampers R&D across therapeutic areas.

The Biotechnology Economic Impact Map

Biotech’s Economic Impact. Go inside the BIO member companies driving the bioeconomy nationwide.

BioSafe

Since 2003, BioSafe, BIO's preclinical safety committee, has been driving innovation in biopharmaceuticals by addressing key regulatory and scientific issues.

Nature's Building Blocks

Explore inspiring videos about how biotech is solving our world’s biggest sustainability, health, and equity challenges, produced in partnership with BBC StoryWorks.

BIO Early-Stage Resources Hub

BIO launched a powerful tool with exclusive resources to help early-stage and startup biotechs save money and stay up to date on the latest insights.

BIO Webinars

BIO’s free educational webinars cover topics ranging from policy to capital raising to member services—anywhere, anytime from your own device.

Price controls on the U.S. Biopharma Ecosystem

New research by Vital Transformation: Inflation Reduction Act hampers R&D across therapeutic areas.

The Biotechnology Economic Impact Map

Biotech’s Economic Impact. Go inside the BIO member companies driving the bioeconomy nationwide.

July 23–27, 2025

Nangang Exhibition Center, Taipei, Taiwan

January 12-15, 2026 | San Francisco, CA

March 2-3, 2026 | Miami, FL

BIO’s committees have given us a chance to be involved with other leaders on the cutting edge of biotech. We share a common goal to advance science and technology in the bioeconomy.

BIO’s strategic advocacy and unwavering leadership in the areas of renewable fuels and industrial products are helping to shape and drive the conversation in Washington and in state capitals across the nation.

We are proud to work with BIO to foster transformational medical innovation to improve the health of all those living with devastating diseases around the world.

If you're an Early-Stage company like we are at Nkarta my dues get paid for by the BIO Business Solution savings...to me, it's a very easy decision to be a part of BIO.

BIO’s committees have given us a chance to be involved with other leaders on the cutting edge of biotech. We share a common goal to advance science and technology in the bioeconomy.

BIO’s strategic advocacy and unwavering leadership in the areas of renewable fuels and industrial products are helping to shape and drive the conversation in Washington and in state capitals across the nation.

We are proud to work with BIO to foster transformational medical innovation to improve the health of all those living with devastating diseases around the world.

If you're an Early-Stage company like we are at Nkarta my dues get paid for by the BIO Business Solution savings...to me, it's a very easy decision to be a part of BIO.

BIO’s committees have given us a chance to be involved with other leaders on the cutting edge of biotech. We share a common goal to advance science and technology in the bioeconomy.